39+ Straight Line Depreciation Calculation

Free depreciation calculator using the straight line declining balance or sum. Web To calculate straight-line depreciation you need to know three pieces of information about your asset.

:max_bytes(150000):strip_icc()/GettyImages-182148191-5661c3cc3df78cedb0b7b349.jpg)

Straight Line Basis Calculation Explained With Example

Web Straight line depreciation is such a method of depreciation calculation.

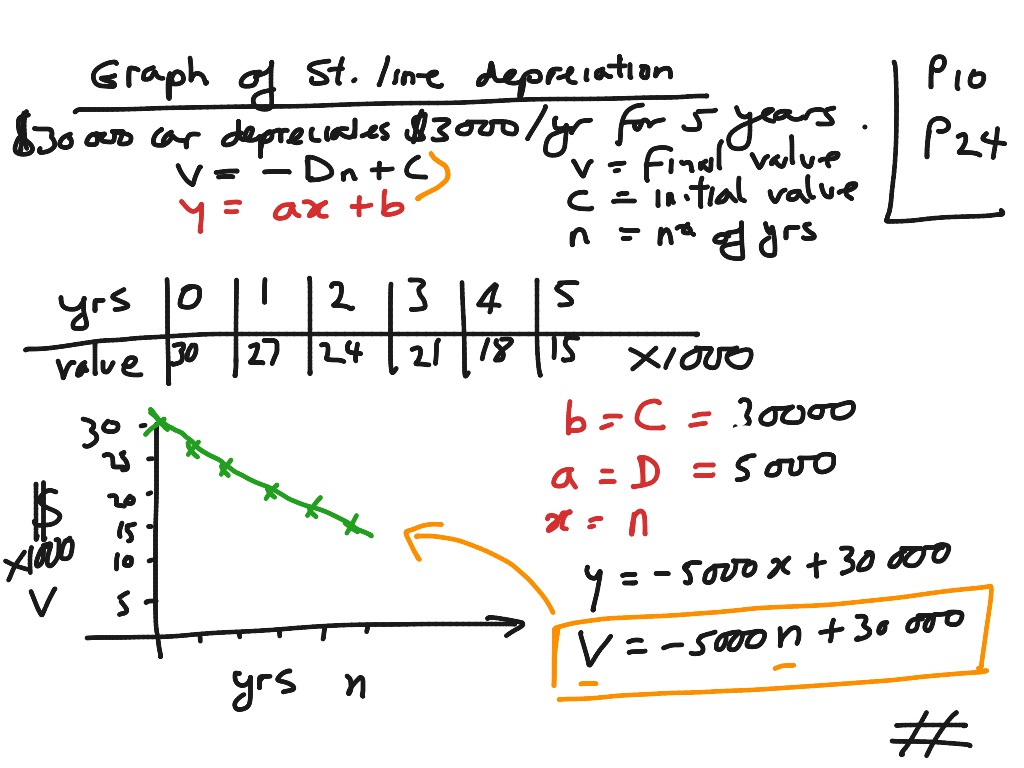

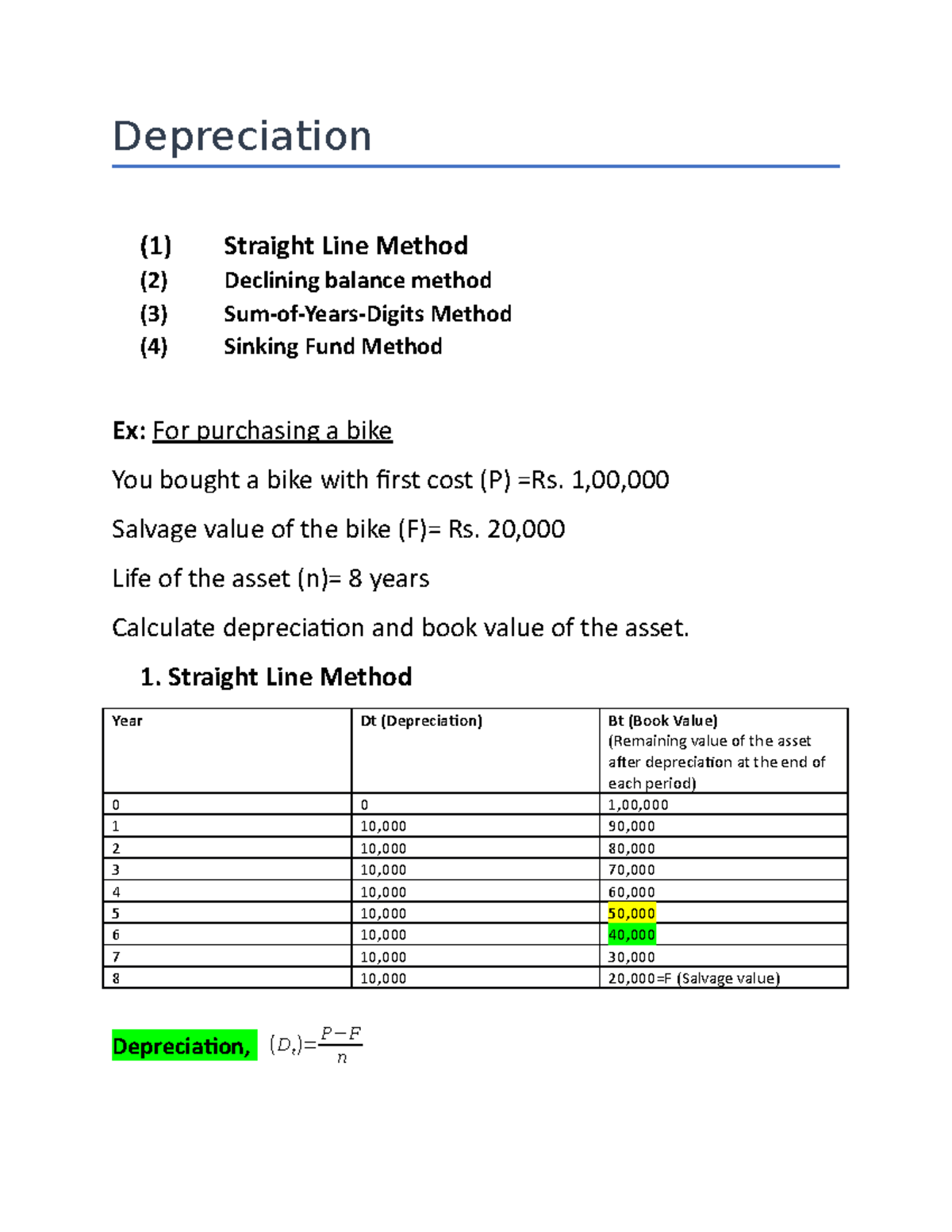

. Web The straight-line depreciation method posts an equal amount of expenses each year of a long-term assets useful life. The concept of depreciation and its types in detail. 1600 Straight Line Depreciation Formula The following.

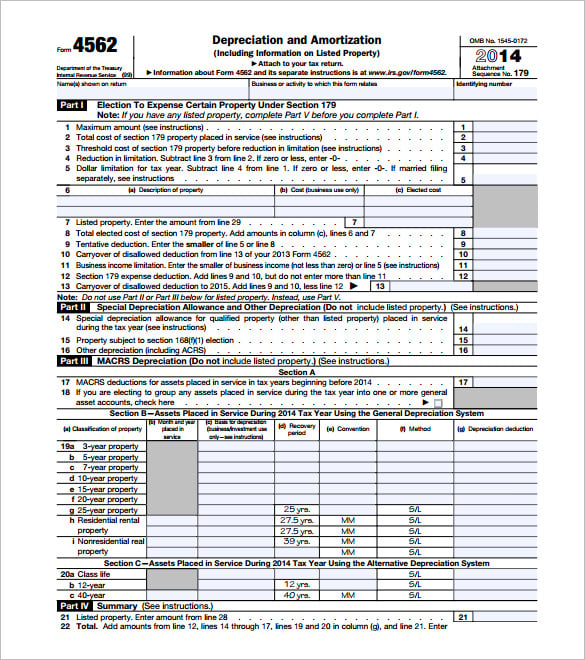

Web Accounting What Is Straight-Line Depreciation. Web Assets with no salvage value will have the same total depreciation as the cost of the asset. Web Under MACRS the deduction for depreciation is calculated by one of the following methods.

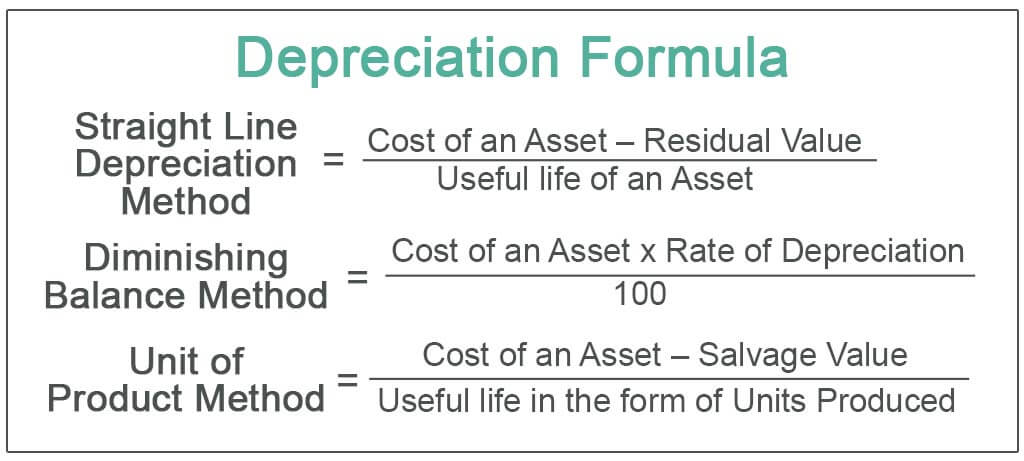

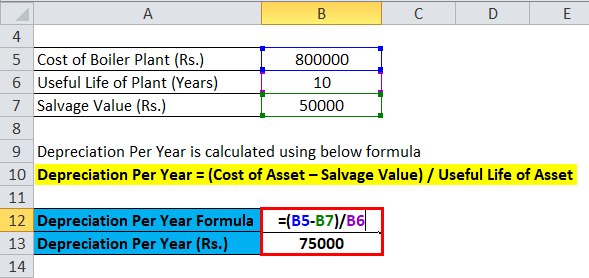

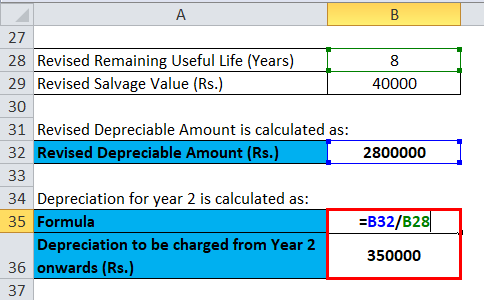

Formula to calculate Depreciation Per Year is. The declining balance method with switch to straight line method The. Web Straight-line depreciation is the depreciation of real property in equal amounts over a dedicated lifespan of the property thats allowed for tax purposes.

This is the easiest method to calculate. Asset Cost The initial cost of purchasing the fixed asset or the capital expenditure. Web Annual depreciation expense purchase price salvage value useful life To help you better understand this formula lets define a few key terms.

Web How to Calculate Straight Line Depreciation. Web Results Depreciable Base. Web The algorithm behind this straight line depreciation calculator uses the SLN formula as it is explained below.

1600 Final Year Depreciation Expense. Web The straight-line depreciation expense is determined by the following three assumptions. Straight line depreciation is perhaps the most basic way of calculating the loss of value of an asset.

Depreciation Per Year Cost. Web The formula for calculating straight line depreciation is. In simple terms the peeling machine can be depreciated by 20 yearly.

Through this post we shall learn about. Straight line depreciation cost of the asset estimated salvage value estimated useful life of an asset. Web Calculate the depreciation to be charged each year using the Straight Line Method.

Purchase price or cost salvage value at the end of its. 8000 1st Year Depreciation Expense. Web 1 Useful life of an asset So the rate of depreciation is 15 02.

Web The first step in calculating straight line depreciation is calculating the cost of the asset. Guide Formula Kristina Russo CPA MBA Author March 31 2022 Depreciation is an accounting process that. The final cost used in the depreciation calculation should include the base.

Periodic straight line depreciation Asset cost - Salvage value.

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Formula Calculator Excel Template

Gaining Xp Paradise Island Hd Wiki Fandom

Class 8 Maths Archives Wbbse Solutions

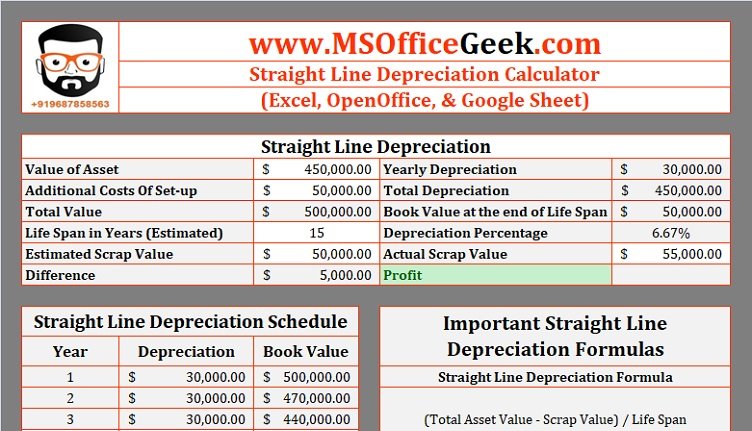

Ready To Use Straight Line Depreciation Calculator Template Msofficegeek

Meaning Of Depreciation In Bookkeeping

Straight Line Depreciation Calculator And Definition Retipster

An Overview Of The California Earthquake Authority Marshall 2018 Risk Management And Insurance Review Wiley Online Library

Straight Line Depreciation Formula Calculator Excel Template

Straight Line Depreciation Graph Math Finance Flat Rate Depreciation Economics Showme

Is This Legit Legal They Took My Money Already And Are Asking For More R Pcmasterrace

Straight Line Depreciation Method What Is It Formula

Depreciation Calculation Questions Depreciation 1 Straight Line Method 2 Declining Balance Studocu

How To Calculate Straight Line Depreciation With Formula

How To Calculate Depreciation Straight Line Method Depreciation Youtube

7 Depreciation Schedule Templates Doc Pdf

Straight Line Depreciation Formula How To Calculate